All electric and plug in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7 500.

Electric car tax credit 2018 income limit.

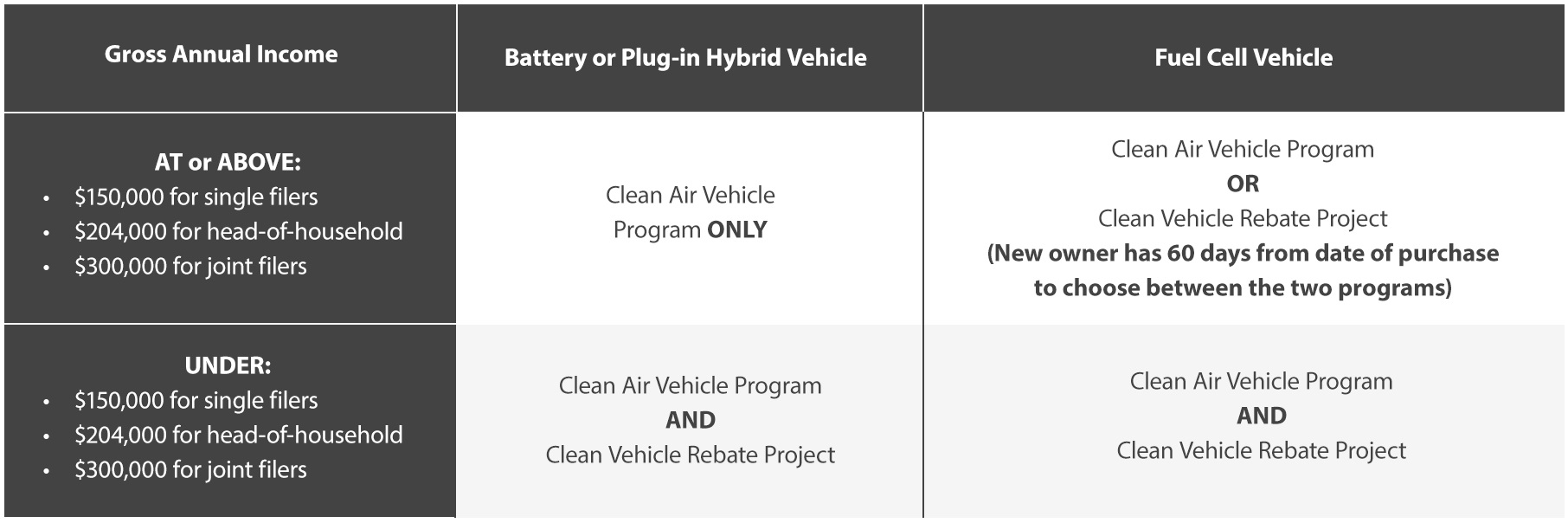

Vehicle date of purchase lease income cap.

In some states however income caps and vehicle price limits may restrict access to tesla tax credits and other incentives.

The exceptions are tesla and general motors.

The credit amount will vary based on the capacity of the battery used to power the vehicle.

There is a federal tax credit available for most electric cars in 2020 for up to 7 500.

November 1 2016 present.

At least 50 of the qualified vehicle s miles must be driven in the state and the credit expires at the end of 2020.

Will there be a federal tax credit for electric cars in 2020.

Chevrolet tax credit the phase out of federal tax credits on the purchase of chevrolet plug in electric vehicles began when its gm parent hit its 200 000 unit cap at the end of 2018.

Drivers who purchase or lease a new or used plug in hybrid electric vehicle receive a 125 credit or a 250 credit for a plug in electric vehicle pev for all toll roads.

New jersey the new jersey board of public utilities offers state residents a rebate in the amount of 25 per mile of electric only range up to 5 000 to purchase or lease a.

The income cap applies to all eligible vehicle types except fuel cell electric vehicles.

These numbers are based on 300.

The table below lists the increased rebate household income limits effective july 8th 2020.

Federal tax credits for new all electric and plug in hybrid vehicles federal tax credit up to 7 500.

For a vehicle purchased on or after january 1 2018.