With this tax credit customers could be getting a rebate on the sales tax they pay up to 2 500 on new electric vehicles that cost less than 45 000.

Electric car tax credit 2018 ohio.

Simply answer a couple of.

At least 50 of the qualified vehicle s miles must be driven in the state and the credit expires at the end of 2020.

You must have purchased it in or after 2010 and begun driving it in the year in which you claim the credit.

Qualified plug in electric drive motor vehicle tax credit.

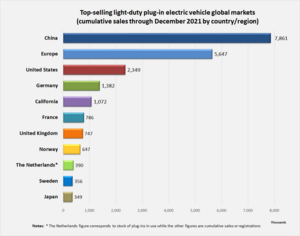

All electric and plug in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7 500.

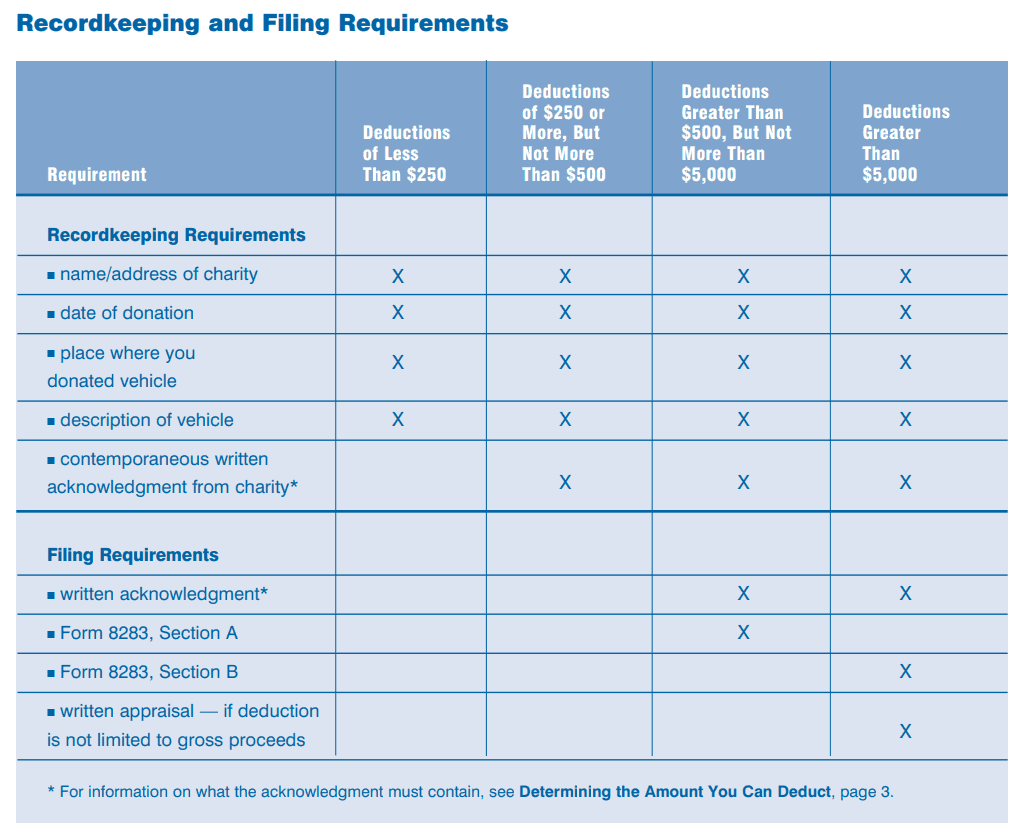

About form 1040 u s.

Its stepped phase out to 50 started on april 1 2019 and continued until sept.

Also use form 8936 to figure your credit for certain qualified two or three wheeled plug in electric vehicles.

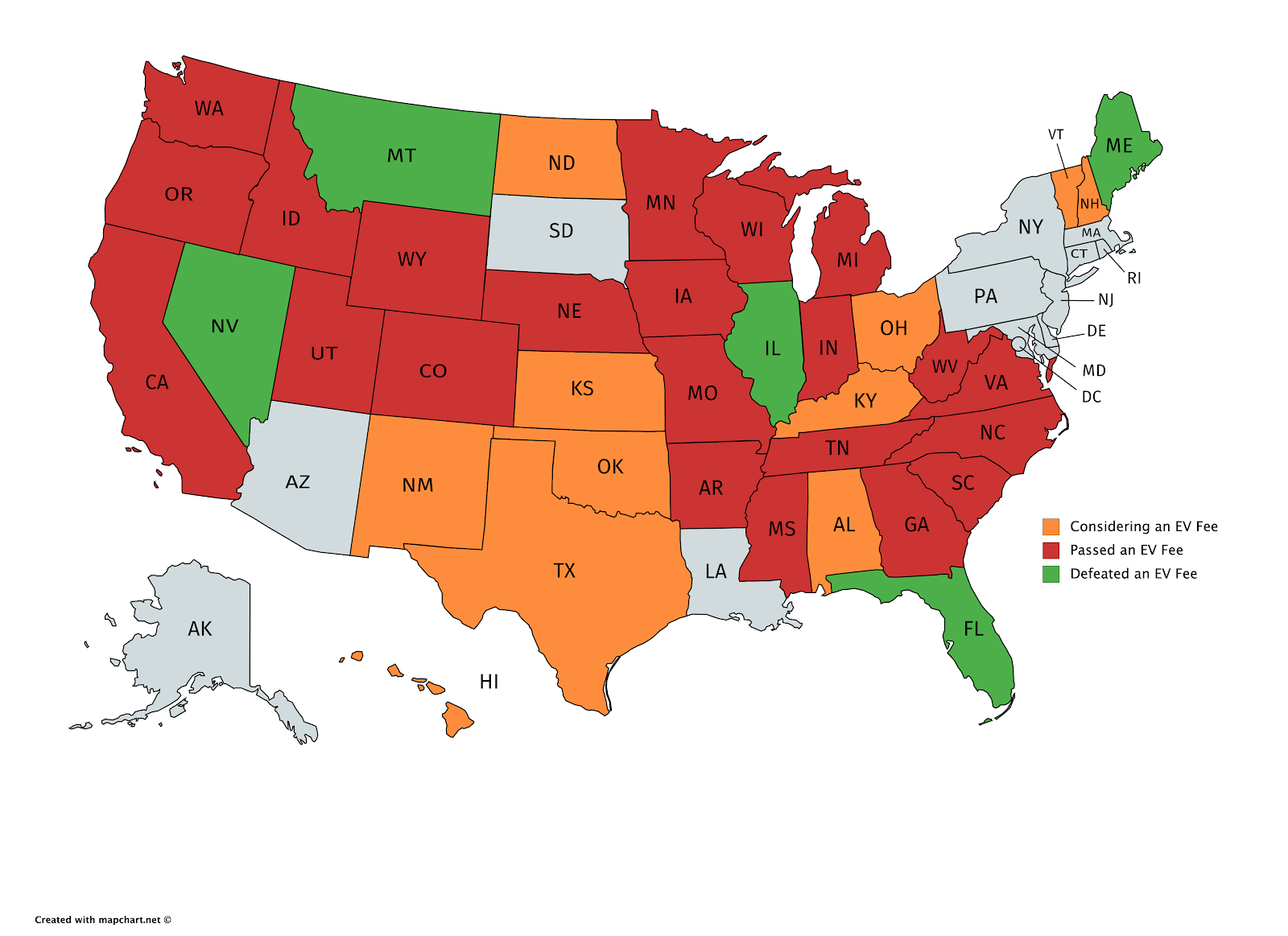

Evs aren t mainstream yet but work is being done in ohio to encourage drivers to go electric.

They can receive a rebate of up to 1 600 on the purchase of used electric cars that retail for under 30 000.

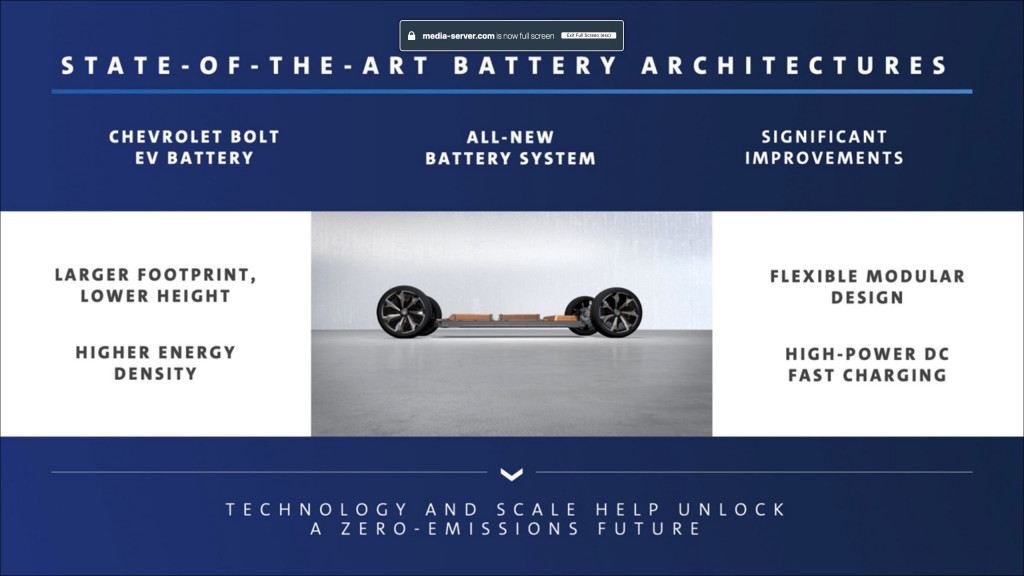

The credit amount will vary based on the capacity of the battery used to power the vehicle.

These vehicle tax credits are available for 2019 tax returns.

Alternative motor vehicle tax credit.

Tax credits for heavy duty electric vehicles with 25 000 in credit available in 2017 20 000 in 2018 18 000 in 2019 and 15 000 in 2020.

The phase out of federal tax credits on the purchase of chevrolet plug in electric vehicles began when its gm parent hit its 200 000 unit cap at the end of 2018.

Federal tax credits for new all electric and plug in hybrid vehicles federal tax credit up to 7 500.

Individual income tax return.

Ohio s co friendly drivers can take advantage of a few money saving green driver incentives if you re on the fence about buying an eco friendly car or already driving a fuel efficient vehicle such as a hybrid or an electric car read more below on emissions test exemptions alternative fuel vehicle grants federal tax credits auto insurance discounts and more.

You may be eligible for a credit under section 30d a if you purchased a car or truck with at least four wheels and a gross vehicle weight of less than 14 000 pounds that draws energy from a battery with at least 4 kilowatt hours and that may be recharged from an external source.