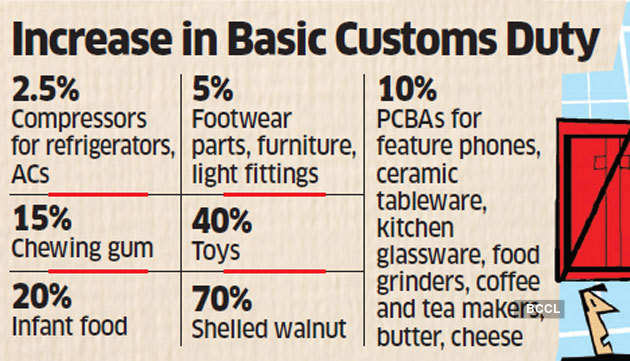

The commission announced that chinese exporters of tableware and kitchenware products involved in circumvention of the eu anti dumping measures will be subject to a double anti dumping duty rate of around 36.

Europ ceramic dumping duty update.

30 sep 2020.

It s designed to allow the eu to take action against goods that are sold at.

The decision follows a thorough investigation launched by the commission on its own initiative ex officio in march this year given a sharp rise in exports of.

The commission has advised in implementing regulation eu 2018 544 oj ref l92 that a request to change the name of a chinese exporting producer of ceramic tableware and kitchenware has been.

On 12th december 2019 the european commission imposed new punitive duties on ceramics from china as part of a new implementing regulation imposing a definitive anti dumping duty.

Conditions to make a complaint.

Today the european commission sanctioned chinese exporters of table and kitchenware involved in circumventing eu anti dumping measures by doubling the duty rate applicable to them.

It is designed to allow the eu to take action against goods that are sold at less.

Anti dumping duty is an import duty charged as well as normal customs duty and is applied across the eu it allows the eu to take action against goods sold at less than their normal value which.

2 council implementing regulation eu no 917 2011 of 12 september 2011 imposing a definitive anti dumping duty and collecting definitively the provisional duty imposed on impor ts of ceramic tiles or iginating in the people s republic of china oj l 238 15 9 2011.

European commission directorate general for trade.

It opens an investigation after receiving a complaint from the european producers of the product concerned.

The european commission is responsible for investigating dumping claims and imposing measures.

Trade defence instruments such as anti dumping or anti subsidy duties are ways of protecting european production against international trade distortions.

Anti dumping duty is an import duty charged in addition to normal customs duty and is applied across the whole eu.